There are so many reasons to spend money, especially when kids come into the picture. Many people may find it incredible or even unbelievable that we save 56% of our income with one kid.

But we do it and so can you!

This post may contain affiliate links; please see our disclaimer for details.

“Among respondents, 20 percent said they aren’t saving anything or don’t have an income. Another 47 percent are saving 1 to 10 percent, and 27 percent are saving 11 percent of their income or more”.

Bankrate

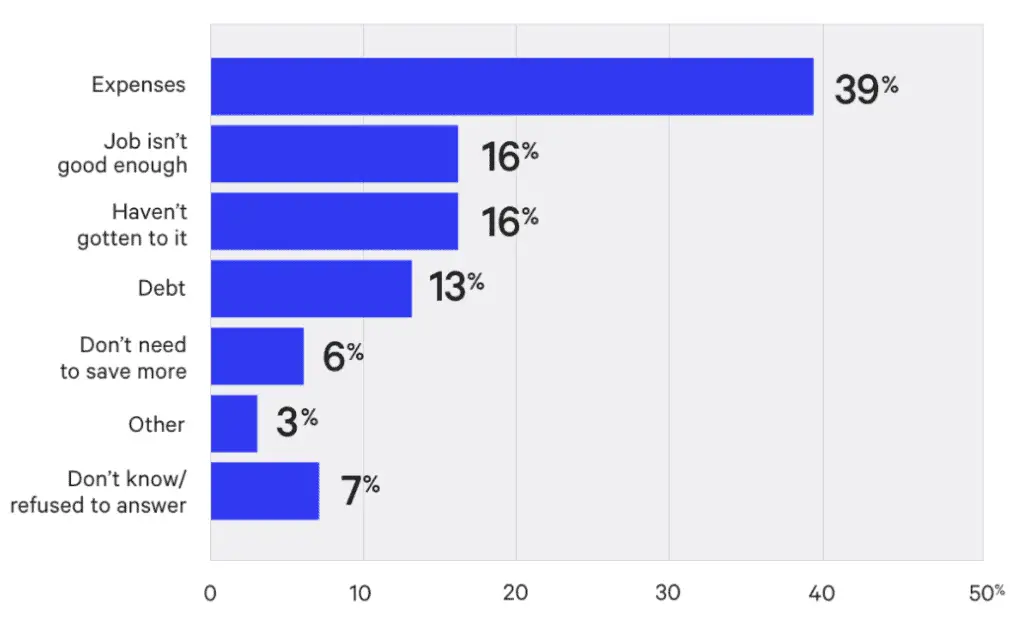

See below for the main reasons people don’t save more money –

Before sharing some must-see saving tips, you probably want to know how much we are currently making right?

My wife and I’s total pre-tax income is currently $100,000 including both of our salaries (basic salary + bonuses) and our extra rental income. After-taxes are we are looking at about $7,000 a month (net).

The 56% is calculated using our net income/after-tax income which equals us saving roughly $47,000 a year.

Related content: How We Budget Our $100K Income as A Family of Three

Now I hope you’re ready for our 12 useful tips – we can’t wait to share them with you!

If you’d like to watch our YouTube video instead, please see the video below.

Table of Contents

1) Pay off all Debt Except for the Mortgage

A lot of debt is being accumulated by individuals all across the world each year.

According to business insider, the average American has $52,940 worth of debt across mortgage loans, home equity lines of credit, auto loans, credit card debt, student loan debt, and other debts like personal loans.

Debt is the enemy of saving!

Debt steals from the money you could be saving!… when you need to pay $500 in debt payments a month, you are actually losing $500 that could have been extra savings each month.

When it comes to how to pay off debt, we are big fans of the debt snowball method and used it to pay off our $56,000 worth of student debt and had one kid.

The journey is not easy but IS worth it.

Now we are 100% debt-free except for the mortgage. Staying away from debt allows us to save (and INVEST) more of our income and reach financial freedom sooner.

2) Avoid Becoming ‘House Poor’

Someone who is house poor has maxed out their mortgage payments so the majority of their income goes to the mortgage.

BTW, those who are house poor are not only includes homeowners but also renters.

We know many people who have maxed out their loans when buying a home. They all have a very high DTI (debt to income ratio) which ends up around 45%.

Ouch!

45% of your pre-tax income all going to debt?! – Big NO-NO for us.

Our largest expense is our monthly mortgage payments but we had a plan when buying a home.

When applying for our house loan our goal was to keep all house costs (mortgage+utilities+internet) under 30% of our net income.

We feel 30% with everything is a healthy percentage. We don’t want to max out our house loan debt because we’d rather not be house poor.

By keeping our mortgage payment as low as possible we are able to have extra cash to save and invest – woohoo!

3) Mint Mobile – Incredibly Priced Phone Plan

Phone plans can get super pricy with long contracts!

Our friends recommended Mint Mobile back in the day and we have been using them ever since.

Their plans have incredible prices with plans as low as only $15 a month!

My wife and I only pay $15 each for our phone plans (a month). Their service has been very reliable. To see these incredible deals, click HERE or on the image below.

4) Cancel Unnecessary Subscriptions

Subscriptions are eating most people’s money every month!

Control the urge to get lots of subscriptions, it’s important to recognize wants verse needs.

Right now our only subscription is with Amazon Prime. Well.. actually that and my Xbox live account. haha

We are fortunate to be able to use our parents’ or other family members’ subscriptions like Netflix, Disney+, and others. Big thanks to my family here!

Amazon Prime has been amazing though and has been worth it for us so we’d like to share some awesome things about it.

Here are 3 main benefits which made us buy and KEEP it.

First, we love the free 2-days shipping.

Second, we love that Amazon Prime offers unlimited photo storage space because we have tons of pictures! If you need to pay monthly for online photo storage, why not just get Amazon prime bundled with the other benefits that they offer?

The third is Amazon music. Their music has been great at increasing my productivity and boosting my mood.

5) Side Hustles

Making an extra $10K is easier than trying to save 10K. The sooner you understand that the sooner your life will improve.

Elon musk

One side hustle that helped us graduate student loan-free is pet sitting!

We love pets! Finding a side hustle you enjoy is the best.

We would help friends or family out to watch their pets. My wife is from China so she knew a lot of international students who don’t have family here so we would help watch their pets while they go back to China.

For us, this was not a job at all and we both enjoy playing with each pet (by the way, we would only watch pets that were fully trained, so it wouldn’t be hard to take care of them).

We also enjoyed using the pet sitting site/app called Rover, if interested you can click HERE for more details.

Another side hustle I took up was donating plasma.

You can make around $400 a month, sometimes even more! Each donation took me around one hour total and up to two donations can be scheduled each week.

Donating plasma was easy and is also for a great cause. I still donate plasma sometimes when they have a good promotion going on.

We hope you can also find something you enjoy for a side hustle!

6) Find a Higher Paying Job

Making more money means you can save and invest more money!

In addition to doing side hustles, I have constantly worked on improving my skills in the workplace to be able to find higher-paying positions.

Back when going to school I would do both full-time school and full-time work. I was able to move up to a supervisor position when I first got married. Next, I was able to obtain an account manager position during the last year of my bachelor’s program. I then became a product development specialist after the first semester of my MBA.

I understand how difficult it can be to leave a position or company you are comfortable with, but I was able to increase my knowledge, capabilities, and income!

Each change in job position gave me about a $15,000 increase in salary.

In total, my salary increased by $30,000 during school! I quickly moved to another position once I became comfortable with my job responsibilities and looked for opportunities to expand my knowledge and skills.

7) Buy a Second-Hand Reliable Car with Cash

The average value of a new vehicle drops around 20% in the first year of ownership, and will drop up to 60% of its value within the first five years!

Buying a reliable car with cash can save you tons of money! Here is my story below –

Ever since I was a kid I loved the Land Rover Discovery model. During college, I decided to get a car loan for a second-hand Land Rover that had high mileage.

I did not realize what I had gotten myself into…

At first things I was living the dream… or so I thought! I would go off-roading with my buddies but then the nightmare arrived.

The vehicle started having many small issues which were VERY costly to repair. Being a Land Rover model, the repairs and basically everything is very pricy.

The cost to fill up on gas was very high and the gas mileage was terrible. Then my tire blew out when off-roading with friends. The cost to replace all tires cost me almost a thousand dollars! I had no savings left over each month and needed to get rid of it.

I was able to sell the vehicle (after a long time) and used the money to pay off my car loan completely.

That was a relief! No more car debt.

I then purchased a second-hand Toyota Corolla from my brother-in-law at a really good price. My brother-in-law has his own car shop and Toyota is his number one favorite brand due to its reliability.

I was very happy with my Toyota Corolla as it had no issues. The gas mileage was also so much better compared to the gas guzzler I previously had.

See HERE for more on my luxury car nightmare story.

8) 48-Hour Cooldown Rule

We all have ‘wants’ that sometimes just feel like needs! lol

It doesn’t help if the thing we want is also something a friend or family member just purchased and is pressuring us to do the same.

My wife and I have set a 48-hour calm time to prevent misspending of our money. Usually, we calm down after a night’s sleep but extending it to 48 hours has worked well for us.

It’s important to distinguish between what you want and what you need – try finding someone else who can support you in the 48-hour cooldown.

If there is still something I really want I will donate plasma as extra money. For example, I really want the brand-new released x-box and I did not cool down haha. So I donated plasma and bought it.

9) Live More Frugal – Buy Second-Hand and Discounted Items

We buy a lot of things second-hand, and found it’s usually not worth it to buy brand new!

We like using the Facebook marketplace and have found items like our baby’s toys, stroller, pack-n-play, and more!

We also look for sales. Before going to Smith’s or Costco, we always check what’s on sale first.

Essentially everything we buy from Costco is on sale, no kidding!

If you have a baby, we highly recommend buying the Target store brand up&up for diapers and wipes.

Here are 4 reasons we recommended using Target –

First, they are one of the cheapest brands out there with good quality. We used Walmart store brand Parents’ Choice which is around the same price, but it doesn’t compare in quality.

Second, Target often offers “buy $100 get $30 off” promotions so I always buy a bunch during those promotions. I think with the promotions, the Target store brand up&up has the cheapest diapers and wipes. At least we haven’t found anything cheaper than that.

Third, Target also offers Target RedCard. You don’t need to open a credit card, just open a debit card! The debit card they have offered 5% cashback when you shop in Target!

Last but not least, Target also has a Target Circle Rewards program. Target Circle is a loyalty program where you can earn 1% in Target Circle earning rewards every time you shop!

The above four reasons can really help parents with babies like us to save A LOT of money. That’s why we are using Target store brand up&up for our babies.

10) Shop Around for Insurance

After we first got insurance we would talk about finding cheaper insurance or bundling but we didn’t do anything for a long time. Thinking back on it now we both regret not taking action to find cheaper insurance faster.

The insurance we currently have is for the car, house, and rental (landlord) insurance.

We switched to an insurance company recommended by our real estate agency. The insurance for our car, home insurance, and landlord insurance are combined/bundled.

Having your car and house insurance together with the same insurance company is usually cheaper. The new insurance company we chose gave us a plan that is cheaper than our old plan by about $100 per month.

Saving an additional $100 a month means you can save $1,200 a year! Making the switch may be well worth it.

11) Minimalize

We started watching minimalism videos and were very intrigued by the idea of simplifying our lives and removing things that do not add value.

This also gave us more motivation to not spend money on things we didn’t need. Having a minimalist mindset helps us know what we really need, we ask ourselves, “does this item really add value to my life?”.

We also don’t want to have too much clutter in our home so we will ask ourselves questions when shopping like “do we need this?”, “is it necessary?”, or “how long/much will I use this item?”.

We are not full-blown minimalists, but the idea teaches us valuable lessons on what matters most and how to save our income.

12) Invest Your Money

When you invest your money wisely, you can earn interest and dividends! You will be making money even while sleeping!

Compound interest is an amazing thing that can really go to work for you.

We highly recommend investing early and starting now. The growth may seem slow at first but it grows like crazy over time!

Check out this example below –

The average monthly student debt payment in the USA is around $400 a month. If you instead invest $400 a month in a reliable fund (like the S&P 500) with average an average return of 12%, you will have around $92,000 in 10 years and ONE MILLION in 28 years!

A great way to start investing is by putting money into some tax advantage accounts like an HSA or an IRA. Tax-advantaged accounts can save you a lot of money in tax!

F1 Finance is a great place to get started with their super easy-to-use app. There are NO commission and account management fees.

It is not just a trading stock brokerage account but also offers an IRA option that allows you to invest in your retirement.

We highly recommend using F1 Finance if you would like to open a brokerage account or a retirement account! For more details on how you can start investing with M1 Finance click HERE or on the image below.

Conclusion

The most important thing to saving your income is to cut down on expenses and increase your income! That’s how we are able to save 56% of our income!

I hope the 12 tips shared can give you a good idea of how to start saving half of your income.

Here is a quick summary of all 12 tips:

- Pay Off Debt Except for the Mortgage

- Avoid Becoming ‘House Poor”

- Mint Mobile, $15 Phone Plan

- Cancel Unnecessary Subscriptions

- Side Hustles

- Find a Higher Paying Job

- Buy a Second-Hand Reliable Car

- 48 Hour Cooldown Rule

- Live More Frugal – Buy Second-Hand and Discounted Items

- Shop Around for Insurance

- Minimalize

- Invest Your Money

What other things are you doing to help you save more each month? Be sure to comment below and share with us!

Disclaimer:

We hope the information in this article provides valuable insights to every reader but we, the Biesingers, are not financial advisors. When making your personal finance decisions, research multiple sources and/or receive advice from a licensed professional. As always, we wish you the best in your pursuit of financial independence!