Are you considering the idea of quitting your job?

You’ve probably heard of the great resignation by now. Many people are looking to leave their current workplace to find more flexible employment, pursue working for themselves, or retire early.

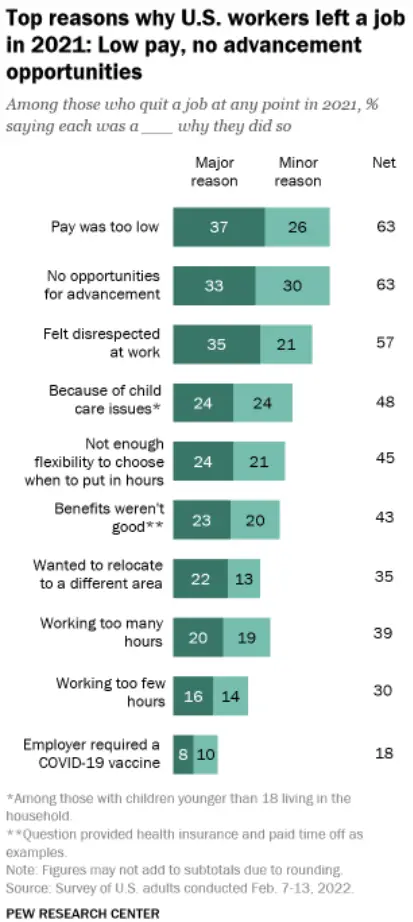

Here are the reasons for the great resignation, according to Pew Research Center:

“Majorities of workers who quit a job in 2021 say low pay (63%), no opportunities for advancement (63%), and feeling disrespected at work (57%) were reasons why they quit, according to the Feb. 7-13 survey. At least a third say each of these were major reasons why they left.”

Roughly half say childcare issues were a reason they quit a job (48% among those with a child younger than 18 in the household).

A similar share point to a lack of flexibility to choose when they put in their hours (45%) or not having good benefits such as health insurance and paid time off (43%). Roughly a quarter say each of these was a major reason”.

It’s crucial to make sure that you do everything possible to prepare for the transition of quitting your job.

Quitting a job can be scary, but if you plan ahead and take the time to do things correctly, it can be a much smoother process.

This article will discuss fourteen things you must do before quitting your job.

By following these tips, you’ll be able to make the transition as smooth as possible!

This post may contain affiliate links; please see our disclaimer for details.

Table of Contents

The Benefits of a Smooth Departure

When you leave a job on good terms, it can benefit you in several ways.

For one, getting a positive reference from your former employer will be much easier.

Additionally, if you ever need to return to that company later down the road, they will be more likely to welcome you back with open arms.

Finally, quitting your job on good terms is simply the right thing to do – it’s respectful and professional.

What Should You do Before Quitting Your Job

There are a few key things you should do before quitting your job. Make sure you do these if you wish to leave on good terms. He

Buckle up because here are fourteen things you should do before you quit your job:

1) Give Enough Time Notice

One of the most important things you can do before quitting your job is to give your employer two weeks’ notice. Although this is standard protocol, giving your employer time to find a replacement for you.

Additionally, by giving two weeks’ notice, you’re showing that you respect your employer and the company.

They will be much more likely to give you a positive reference if you give them this courtesy.

Schedule a meeting with your boss to deliver the news in person.

This way, they can ask any questions, and you can explain your decision further.

Giving two weeks’ notice is one of the most important things you can do when quitting your job – make sure not to forget it!

2) Clean Up Your Work Area

Another thing you should do before leaving is to clean out your desk.

Doing so shows that you respect your employer and their property and makes the transition easier for your successor.

Plus, once you’ve cleaned your desk, you won’t have to worry about returning to retrieve any personal belongings – they’ll all be gone!

To clean your desk, start by going through all your drawers and removing any personal items.

Next, review your files and remove anything specific to you or your work. Finally, wipe down your surfaces and vacuum the floor around your desk.

By taking the time to clean out your desk before quitting, you’re making things much easier for everyone involved.

3) Tie Up Loose Ends

Before quitting your job, you should also take the time to tie up loose ends.

Make sure to finish any projects you’re working on, wrap up any open tasks, and ensure that everything is organized and in its proper place.

Tying up loose ends before you leave shows your employer that you’re a responsible and reliable employee. Additionally, it will make the transition smoother for whoever takes over your role.

So take time to finish up anything incomplete – it will benefit everyone involved!

4) Train a Backup or Replacement

If possible, you should also try to train your replacement before leaving your job.

This is a great way to show that you’re committed to the company and want to see it succeed – even after you’re gone.

Training your replacement can be as simple as showing them how to do your job, answering any questions they may have, and providing helpful feedback.

Of course, not everyone will be able to train their replacement, but if you can, it’s worth doing!

5) Save For a Rainy Day

Before quitting your job, you should also save up some money.

This way, you’ll have a cushion in case you need it – whether for unexpected expenses or to tide you over.

Most experts recommend saving up to three to six months’ worth of living expenses, but depending on your situation, you may want to save more.

Ideally, it would help if you aimed to save enough money to cover your living expenses for at least three months. This may seem like a lot, but it’s better to be safe than sorry!

You can learn everything you need to know about emergency funds by visiting our article – Emergency Fund – What is It and Why You Need One

6) Create Sources of Passive Income

Another important thing to do before quitting your job is to create at least one source of passive income. This will help you keep financial stability even when you’re not working a traditional job.

There are many ways to create passive income, but some of the most popular methods include investing in real estate or stocks.

You can even create a passive income source such as a blog, youtube channel, or online business.

Creating a source of passive income is a great way to prepare for quitting your job – it’ll help ensure that you’re still able to support yourself financially even when you’re not working!

If you are transitioning to another job, having a source of passive income can still be a helpful safety net.

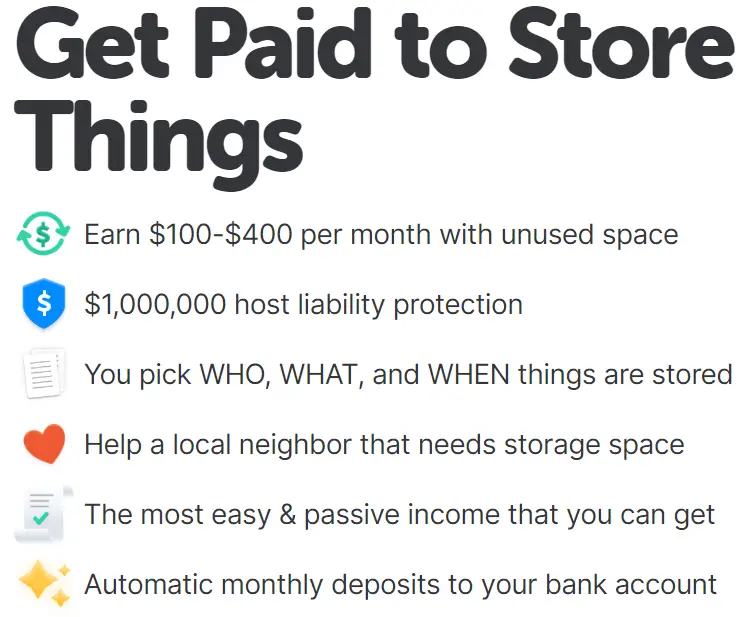

An excellent way to increase your PASSIVE income is by renting out extra space! With NEIGHBOR, you can easily rent out extra space, such as your garage, self-storage unit, rooms, etc.

7) Have a Plan B

In addition to saving money and creating a source of passive income, you should also have a Plan B in case quitting your job doesn’t work out.

Your Plan B could be anything from finding another job to moving in with family or friends. The important thing is that you have a backup plan in case things don’t go as planned!

Having a Plan B is always a good idea – you never know what might happen, so it’s better to be prepared!

When we quit

8) Continue Your Relationship with Co-Workers

Just because you’re quitting your job doesn’t mean you have to say goodbye to your co-workers!

If you have a good relationship with them, there’s no reason why you can’t stay in touch after you leave the company.

You can stay in touch with your co-workers by connecting on social media, meeting up for coffee or lunch, or simply sending them an email now and then.

Staying in touch with your co-workers is a great way to maintain relationships and keep networking – even after you’ve left your job!

9) Get Out of Bad Debt

If you are quitting your job to enter a new career that provides a stable income, this is the time to pay off your debts.

By doing so, you can start your next adventure with a clean slate and without the stress of debt hanging over your head.

If you are quitting your job to pursue a more risky career with an unstable income, it is even more important to get out of debt before making the switch.

This will provide a safety net if your new career doesn’t work out as planned.

No matter your reason for quitting your job, it’s always a good idea to get out of debt before making the switch.

Then you can ensure the start of your new chapter in life happens on the right foot!

There are a few different ways to pay off debt, but the most important thing is to make a plan and stick to it!

You can also talk to a financial advisor to help create a debt payoff plan.

10) Have Life Insurance Figured Out

When it comes to life insurance, there are two main types: term and whole life.

The main difference between whole life and term life insurance is that whole life insurance provides lifelong coverage. In contrast, term life insurance only covers you for a specific period.

Make sure to have life insurance figured out before quitting your job.

To learn more about the differences between term vs. whole life insurance, check out our other article – Term Vs Whole Life Insurance: What’s The Difference?

11) Set Up Your Health Insurance

Health insurance after quitting your job is very important to help keep you and your family safe + healthy.

The rules and premiums may change based on where you obtain your new health insurance.

According to Investopedia, here are the best health insurance options for self-employed:

- Best overall: Blue Cross Blue Shield

- Best Network: United Healthcare

- Best for Preventative Care: Kaiser Permanente

- Best for Convenience: Cigna

- Best for Underserved Groups: Molina Healthcare

- Best for Customer Service: Oscar

If interested, I put together this article on The Best Affordable Health Insurance Options for Early Retirement

12) Keep Investing For Retirement

Don’t forget to keep investing in your tax-advantaged retirement accounts to prepare for a long & happy retirement.

NerdWallet explains there are “five main choices for the self-employed or small-business owners: an IRA (traditional or Roth), a Solo 401(k), a SEP IRA, a SIMPLE IRA or a defined benefit plan”.

Make sure to look through each option and find which choice works best for you.

The Bottom Line

That’s it! These are the fourteen things you should do before quitting your job.

Following these steps ensures that leaving your job goes as smoothly and stress-free as possible.

Quitting your job can be a big decision, but it doesn’t have to be the world’s end.

If you take the time to prepare for it properly, you can set yourself up for success – even after you’re gone.

So if you’re thinking about quitting your job, be sure to keep these things in mind!

Disclaimer:

We hope the information shared in this post provides valuable insights to every reader but we are not financial advisors. When making your personal finance decisions, we recommend researching multiple sources and/or receiving advice from a licensed professional.