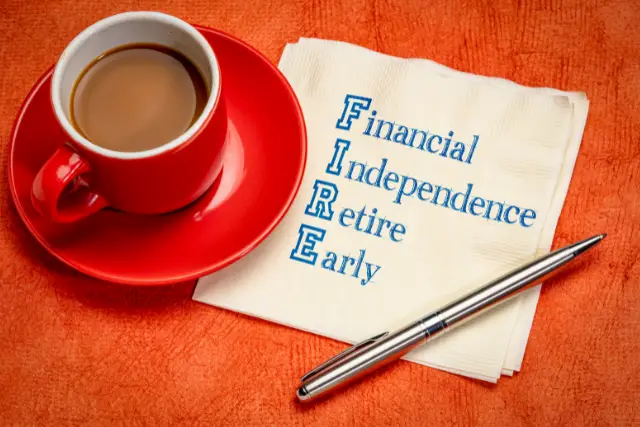

You may have heard the term FIRE before, but you might not know what it means.

FIRE is an acronym that stands for Financial Independence, Retire Early, and is a goal we have set for our family.

It is part of a movement that has been gaining popularity in recent years as more and more people are looking to retire sooner rather than later.

There are different ways to achieve FIRE, but all of them require planning and discipline.

In this blog post, I’m excited to share with you the basics of the FIRE movement and how you can use it to achieve early retirement!

This post may contain affiliate links; please see our disclaimer for details.

Table of Contents

What Is the F.I.R.E. Movement?

The FIRE movement is all about achieving financial independence and retiring early.

The general idea is to save as much money as possible so that you can eventually quit your day job and live off of your investments.

There are different ways to achieve FIRE, but all of them require planning and discipline.

These two factors are key to achieving your financial goals.

Related Content:

Main Types of FIRE

Generally speaking, there are two main types of FIRE: Fat FIRE, and Lean Fire.

Fat FIRE is focused on saving enough money so that you can retire early and still maintain your current lifestyle.

This requires a higher savings rate than lean FIRE, but it allows you to enjoy your life while still working towards your financial goals.

Strategies for achieving Fat FIRE:

Strive For Higher Income – One strategy is to work towards a high salary. This means finding a career that you’re passionate about and making the most of your earning potential.

You can also look for ways to make extra income so that you can boost your investing rate.

Diverse Income Sources – Another strategy is to focus on building up your passive income streams.

Some ways you could do this is by investing in rental properties, dividend stocks, or peer-to-peer lending.

The more sources of income you have, the easier it will be to reach your financial goals.

Invest Your Money Wisely – Once you have saved up enough money, you will need to invest it wisely in order to achieve your financial goals.

This can be done by diversifying your investments and making sure that you are invested in a variety of different asset classes.

Create Multiple Streams of Income – Another way to achieve Fat FIRE is by creating multiple streams of income. You could invest in real estate or start a side business. By having multiple sources of income, you will be able to reach your financial goals sooner.

A great way to start investing in real estate without a lot of money is with Fundrise, a crowdsourcing real estate investing platform.

With investment minimums of ONLY $10, you can start making PASSIVE INCOME with your real estate investment portfolio!

This type of FIRE is helpful for people that want to retire early but don’t want to make major lifestyle changes. It can take longer to achieve Fat FIRE, but it may be more sustainable in the long term.

Lean Fire is focused on saving enough money so that you can retire early and live a frugal lifestyle. This type of FIRE is similar to Fat FIRE, but it does require you to make a few more sacrifices.

Strategies for achieving lean FIRE:

Save as much money as possible – You will need to save a large percentage of your income in order to achieve Fat FIRE. This can be done by living a frugal lifestyle and making sacrifices in order to increase your savings rate.

Live Below Your Means – One of the most important things to do when trying to achieve lean fire is to live below your means. This means being mindful of your spending and only buying what you need. It also means being willing to make sacrifices in order to save more money.

Reduce Expenses – Another way to achieve lean fire is by reducing your expenses. This can be done by cutting back on unnecessary luxuries and finding ways to save money on your essential expenses.

There are a number of different strategies that you can use to achieve lean fire. The most important thing is to find what works for you and stick with it. If you’re disciplined and patient, you can achieve your goal of retiring early.

Lean Fire is a good option for people that want to retire early and do not need luxury experiences or high-ticket products.

It can take less time to achieve Lean Fire, but it can also be less sustainable in the long term.

How to use the FIRE method to retire early?

If you want to achieve FIRE, there are a few things you need to do:

First, you need to figure out how much money you need to retire.

The amount needed will be different for everyone depending on their lifestyle and retirement goals.

Once you have this number, you need to start saving and investing!

The earlier you start, the easier it will be to reach your goal.

One of the best ways to save money is to invest in yourself.

You can invest your time to learn about personal finance and investing. The more you know about these topics, the better equipped you’ll be to make smart decisions with your money.

As mentioned earlier, another way to reach your FIRE goals is to live below your means.

Often jealousy or insecurities prevent people from doing this, but it’s one of the smartest things you can do for your finances.

When you live below your means, you have more money to save and invest.

When you have these metrics figured out, it’s time to increase your income.

You can also invest in assets that produce passive cash flow.

To improve your income, try learning about negotiating if you are employed and sales skills if you are self-employed.

By improving your earned income, you can save more money each month to reach your FIRE goals.

Some passive income-producing assets are real estate, index funds, and dividends stocks. You can also create cash flow by starting a business, starting a blog or writing an e-book.

Once your passive income is above your expenses, you can officially state that you have achieved FIRE. This is because you’re free to spend your time as you’d like.

Your assets pay for your liabilities and you will no longer have to work for money.

However, just because you don’t have to work for money, doesn’t mean you can’t still earn some.

For example, if you enjoy writing, you can work as much as you’d like as a freelancer.

You will still be generating an income, but you’ll be doing it on your own time.

Of course, you could also just spend your time relaxing and enjoying your newfound freedom.

Having delayed gratification is also important when attempting to achieve FIRE.

You need to be ready to sacrifice current consumption for the chance to retire early.

You need to have a plan and be patient in order to achieve your FIRE goals. If you continue to spend on the latest sales and new releases, you will be stuck in a cycle of working to pay for your expenses.

Instead, try investing in assets and reinvesting the cash flow from those assets. This can really begin to snowball and help you reach FIRE much sooner than if you just continued working and spending as usual.

Limiting liabilities can also help you achieve FIRE. A liability is something that costs you money each month, such as a car payment or credit card debt.

If you can pay off your liabilities and live without them, you’ll be one step closer to Financial Independence and retiring early.

Another way to achieve FIRE is by finding creative ways to save money. This could include things like couponing, living in a van or RV, or house hacking.

By finding creative ways to save money, you’ll have more money to invest and reach your FIRE goals faster.

The last thing you need to do is have patience and discipline. Retiring early doesn’t happen overnight.

It takes time, effort, and sacrifice. But if you’re willing to put in the work, FIRE is attainable.

By developing systems and having a long-time horizon, you can achieve your goal of retiring early and enjoy a life of financial freedom.

If you’re willing to make some sacrifices and put in the work, you can achieve FIRE.

It might take some time, but it will be worth it when you reach your goal and can enjoy a life of financial freedom.

The Bottom Line

So there you have it!

These are just a few tips on how to retire early using the FIRE method.

By exercising patience, discipline, and being willing to make sacrifices, you can achieve your goal of financial independence!

Start planning and saving today so that you can enjoy a stress-free

When pursuing FIRE, remember the different types and see which one works best for you.

Lean FIRE can be quicker to achieve but does not leave you much room for luxury expenses. If you are minimalistic, this can be a great option for you.

If you want to have a little more wiggle room in your budget, try Fat FIRE. This will take longer to achieve but will give you more breathing room in your budget.

Whatever route you decide to take, remember that FIRE is attainable for anyone willing to put in the work.

The bottom line is that FIRE is a great way to achieve financial independence and retire early.

So what are you waiting for?

Start planning your FIRE today!

Disclaimer:

We hope the information in this article provides valuable insights to every reader but we, the Biesingers, are not financial advisors. When making your personal finance decisions, research multiple sources and/or receive advice from a licensed professional. As always, we wish you the best in your pursuit of financial independence!