If you’re looking for tips on how to start investing in Real Estate in your 20s, you’ve come to the right place!

This post may contain affiliate links, please see our disclaimer for details.

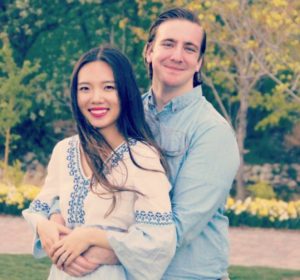

In this article, I’m excited to share with you how my wife and I purchased our first real estate property in our early 20s. We were both college students, ages 21 and 23. I will also share eight tips to save up a downpayment, and much more.

You probably already know that investing in real estate at a young age can have many benefits.

When my wife and I were young college students we started looking for our first home. We learned firsthand how investing in real estate is possible, even for busy college students with low-paying jobs!

Shan (my wife) and I worked very hard to reduce our expenses, save more money, and find ways to make more money to build up our first down payment.

Purchasing your first home not only gives you a safe place for loved ones but also presents you with the opportunity to build wealth over the long term. There’s no better time to start investing than than RIGHT NOW!

If you prefer to watch this story, check out my YouTube video below!

Table of Contents

How Our Real Estate Investing Started

Shortly after getting engaged to my sweetheart in December 2016, we discussed whether we should rent or buy a home after getting married.

My in-laws were landlords in China, so my wife grew up with investors and always had a fascinating perspective on real estate and investing.

People we knew would encourage us to rent since we were still in college, but Shan kept telling me we should work hard to buy a home instead.

My grandpa (father’s side) was a builder who owned many investment properties. So I was intrigued by the idea of buying a property that could be turned into an asset/rental property in the future.

The main concern was that it would be too expensive, but I was reminded how we don’t need the fanciest property on the block.

We would have the amazing opportunity to rent it out in the future instead of paying rent to a landlord. Not to mention extra passive cash flow each month… sounded pretty amazing to me.

Shan and I quickly agreed that our first property would NOT be a forever home but WOULD be an excellent investment opportunity!

So we started comparing locations and properties to find the best deal and place for our future rental.

Shan found a townhome in a stellar location – the unit was close to two prominent colleges. We both felt it would be a great investment property since it would be easy to rent out.

That’s when we started seriously discussing how to cut back on spending and save up enough money to purchase it!

Later in 2018, we converted our townhome to a rental property. I wrote another article on How We Became Landlords At Age 22 As College Students. Check it out for real tips on how to become a landlord.

Life Lesson Moment

An important lesson I learned when starting my investing journey was to think “how can I make something happen” instead of going to the default of saying “I can’t do that”, or “that’s too difficult at my age”.

My original plans were not to become a landlord at such a young age, but I realized that dreams are possible if you work hard at it – and having a partner who is on the same page financially certainly helps!

Remember that success is inevitable as long as you are determined, resilient, pivot when needed, and work hard.

Never put boundaries or limits on yourself when chasing your dreams and goals! Ok enough about our origin story; let’s jump into the juicy details.

How We Saved Up A Down Payment

1. Moved in with Parents: After my wife accepted my wedding proposal (sigh of relief that she accepted), we moved in with my parents. We were very fortunate to have this option which helped us to save more money.

2. Switched to full-time work: I switched from working a part-time job to a full-time job. All while going to school full-time.

3. Promoted at Work: Doing this provided a needed boost to our combined income. Not long after working full-time, I was promoted to bilingual supervisor with an additional bump in pay.

Balancing full-time work + full-time school is no easy task (as many of you already know), but looking back I can say it was worth it.

4. On-Campus Job Discounts: Shan was an international student and was only allowed to work on school campus as a part-time employee, but that didn’t mean there weren’t other perks to her job.

We both enjoyed discounts whenever we ate or shopped on campus. Doing so helped us cut down a lot on eating costs.

5. Help with Wedding Expenses: We are also fortunate to receive help with most of our wedding reception expenses from my parents with my in-laws helping cover other costs such as my wife’s dress and our honeymoon trip.

6. Not Buy Expensive Rings: The only thing we spent money on by ourselves for our wedding were our rings, but wait, we only spent $150. I was surprised but touched when Shan said she would rather put that money towards a downpayment.

In a nutshell, we saved as much as we could. We focused on doing everything possible to cut back on spending and only buy what we needed.

7. Sold Car: Another reason I was able to get some more cash is that I made the difficult decision to sell my luxury car. It was older and high in miles, so we couldn’t get a ton out of it but it helped quite a bit with our downpayment.

An accumulation of many small decisions saved us considerable amounts of money in the long run.

In May of 2017, Shan and I were happily married after just finishing another semester of school.

8. Summer Break = Work MORE: During that summer, I worked another additional job to save more money for our down payment (one full-time + one part-time job).

Three months later, we had finally saved enough money for a down payment. We could start looking for our first real estate property!!

Find The Best Real Estate Property, For Your Budget.

Shan and I looked at many locations and properties close to two colleges.

We calculated our combined income and set a budget. Maxing our mortgage out would have significantly restricted our cash flow each month.

Related Content: How We Save 56% of Our Income [Family of 3]

The perfect property for our budget was a townhome listed for $100,000.

The property was built in 1970 with two bedrooms and 1.5 baths.

Although an older property, the previous owner did some nice remodeling like repainting walls and putting in new wood floors!

Our offer was accepted, and we couldn’t have been happier!!

Through all of our hard work, we were able to put down a $20,000 down payment. Since the down payment was 20% of the house value, we did not need to pay mortgage insurance!

Our monthly mortgage payment was just $850, including HOA, utilities, and internet.

I still remember on closing day when the title company worker said, “wow! your monthly mortgage payment is even less than the rental prices around here”.

It’s important to find the best rate and deal at closing. We highly recommend finding at least three different lenders to compare and negotiate with.

One of the lenders we worked with told us they would take a cut on their own commissions to give us the best deal.

If you are a first-time homebuyer, you may be wondering which documents you’ll need to give your lender.

Below are the most common documents you’ll need when applying for a home loan or refinance. Your lender may ask for additional documents on a case-to-case basis.

Common documents when applying for a mortgage:

- 2-years of tax returns

- Pay stubs, W-2s, or other proof of income

- Bank statements and other assets

- All of your debt monthly payment history

- Credit score, credit history

- Gift letters (if someone helps you with a down payment etc.)

- Photo ID, SSN

- Rent history if you are renting, mortgage/HOA history if you are a house owner

- House insurance company if you have a preference, usually it will be cheaper when you bundle it with car insurance.

- If you have tenants, include your rent payment history & current lease agreement.

Our First Property 🙂

If you are tight on cash and looking for an affordable way to invest in Real Estate now, then FUNDRISE is an excellent choice. They provide a crowdsourcing real estate investing platform where the investing minimums are only $10.

Conclusion – FIRE Journey Ignited

By September 2017, we had successfully closed our first real estate property!

My wife was 21 years old, and I was 23. The underwriting process and everything took approximately one month to be completed.

Waiting for the underwriting and everything felt like forever since it was our first time going through the process. We were worried we might be denied the loan amount, but everything went smoothly, and we were approved.

Not only did we take a significant investment step, but we also kickstarted our FIRE journey!

We have become very passionate about taking control of our finances, living below our means, and making our money work HARD for us.

Check out other articles in our blog where we share our financial freedom stories with tips on personal finance & investing!

Disclaimer:

We hope the information in this article provides valuable insights to every reader but we, the Biesingers, are not financial advisors. When making your personal finance decisions, research multiple sources and/or receive advice from a licensed professional. As always, we wish you the best in your pursuit of financial independence!