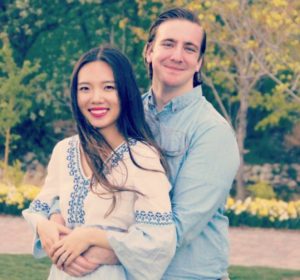

After first getting married to my sweetheart, both I and my wife are just college students and our net worth was way in the negative. A very large chunk came from student loans.

Through patience, continual learning, and persistence, we turned our net worth from a negative to a positive of $350,000. This happened during our 4 years and a half years of marriage.

This post may contain affiliate links; please see our disclaimer for details.

Right now, my wife is 25 and I am 27 years old. We are completely debt-free except for our two real estate property loans.

We are excited to share with you today how we went from being in debt to having $350,000 net worth in 4 years during college.

Related Content: Breakdown of our $350K Net Worth at Age 25.

Table of Contents

1. Increase in income

Increasing one’s income is very important to getting out of debt and building one’s net worth. Making an extra $5000 is easier than trying to save $5000.

There are two main ways to increase your income.

First, find side hustles. Second, find a higher-paying job.

Side hustle experience

My wife and I love pets, and helping take care of others’ pets has been an excellent side hustle.

We would help friends or family out to watch their pets. My wife is from China, so many international students don’t have family here. We would help watch their pets while they go back to China.

For us, this was not a job at all, and we both enjoyed playing with each pet (by the way, we would only watch fully trained pets, so it wouldn’t be hard to take care of them).

We also enjoyed using the pet sitting site/app Rover; if interested, click HERE for more details.

We hope you can also find something you enjoy for a side hustle!

Find a higher-paying job

Making more money means you can save and invest more money!

In addition to doing side hustles, I have constantly worked on improving my skills in the workplace to be able to find higher-paying positions.

Back when going to school I would do both full-time school and full-time work.

Having full-time school and full-time work is no easy task. As many of you already know, it takes grit and perseverance, but don’t worry there is light at the end of the tunnel!

Related content: How to Balance Full-Time School and Full-Time Work (10 Helpful Tips)

I moved up to a supervisor position when I first got married. Next, I was able to obtain an account manager position during the last year of my bachelor’s program. I then became a product development specialist after the first semester of my MBA.

In total, my salary increased by $30,000 (all while still going to school!).

The company I work at as a product development specialist is amazing. They even offered me $3000 each year of tuition reimbursement.

For my two years of studying for my MBA, I received a total of $6000 for tuition reimbursement.

2. Save and Budget

“It’s not how much money you make, but how much money you keep…”

Robert Kiyosaki

Imagine two people, someone who makes $100,000 a year and spends all of it and someone who makes $50,000 a year, only spends $30,000 and invests $20,000.

Which one is on the path to financial freedom and building net worth?

High income does NOT equal wealth. Saving and investing wisely are skills of the truly wealthy.

One way to save money is by using an affordable phone plan.

Mint Mobile has helped us save tons of money, especially during college! We all know how phone plans can get pricy with long, frustrating contracts.

Our friends told us about Mint Mobile many years ago. For many reasons, we are still using them today!

Mint Mobile offers amazing plans at incredible prices, with plans as low as only $15 a month! My wife and I pay only $15 monthly for our phone plans. Check out how you can save money with them today!

3. Pay off all debt except the mortgage

“Debt is the slavery of the free.” – Publilius Syrus

A lot of debt is being accumulated by individuals across the world each year.

According to business insider, the average American has $52,940 worth of debt across mortgage loans, home equity lines of credit, auto loans, credit card debt, student loan debt, and other debts like personal loans.

Debt is the enemy of saving!

Debt steals from the money you could be saved and invested!… when you need to pay $500 in debt payments a month, you are actually losing $500 that could have been extra investment each month.

When it comes to how to pay off debt, we are big fans of the debt snowball method and used it to pay off our $56,000 worth of student debt and had one kid.

The journey is not easy but is worth it.

We are 100% debt-free except for the mortgage. Staying away from debt allows us to save (and INVEST) more of our income and reach financial freedom sooner.

4. Invest in tax-advantaged accounts

Whenever we hear or see the word tax-advantaged, we pay special attention to learn all we can about it.

My wife and I love tax advantage accounts because we don’t want to worry about tax at all when we retire. The thought of being a tax-free millionaire in the future is exciting.

When you invest your money wisely, you can earn interest and dividends! You will be making money even while sleeping!

Compound interest is an amazing thing that can really go to work for you.

We highly recommend investing early and starting now. The growth may seem slow at first but it grows like crazy over time!

Check out this example below –

The average monthly student debt payment in the USA is around $400 a month. If you instead invest $400 a month in a reliable fund (like the S&P 500) with average an average return of 12%, you will have around $92,000 in 10 years and ONE MILLION in 28 years!

A great way to start investing is by putting money into some tax advantage accounts like 401Ks, HSA, IRAs, etc. Tax-advantaged accounts can save you a lot of money in tax!

M1 Finance is a great investment opportunity with its robust yet simple app. There are ZERO commissions or account management fees.

Deposits $1,000 or more into your M1 Invest account within two weeks of signing up and get a cash bonus of $30-$500 to that account.

It is not just a trading stock brokerage account but also offers an IRA option that allows you to invest in your retirement.

We highly recommend using M1 Finance to open a brokerage or retirement account! M1 Finance can undoubtedly help you on your financial independence journey.

5. Invest in real estate

Real estate investing, even on a very small scale, remains a tried and true means of building an individual’s cash flow and wealth.

Robert Kiyosaki

Real estate is a very hot investment topic and an incredible tool to help achieve FIRE (Financial Independence Retire Early).

Many think a lot of money is needed to start investing in real estate, but this is not always true.

You may have heard of people who have achieved great success in real estate investing. Our success may seem small to some but we would like to share our story.

In total, we have purchased three properties. We sold our our first property to help me graduate student debt-free.

At ages 21 and 23, we purchased our first real estate property. Then we became first-time landlords at ages 22 and 24.

At that time we were just regular college students. We did not have a lot of money and did not have high-paying jobs!

We started our real estate investment journey with only $20,000.

Now $20,000 has become $250,000 in 4 years while going to school.

So what was our real estate investment strategy?

- Buy as owner-occupied (residential property).

- Do some easy remodeling while living there.

- Save up a downpayment for the next property.

- Buy the next house and rent out the previous one.

The past few years have been a very good time to invest in real estate in Utah. We were able to buy a house when the price was still relatively cheap, and then watch it increase in value.

The value is still increasing and having rental income as passive income is an amazing thing!

We are so grateful we have been able to make $250,000 profits in 4 years from real estate as college students

We for sure made mistakes as new young landlords at the beginning, but we have learned a lot from our landlords’ journey.

As for a recap:

- Increase income

- Save and budget

- Pay off all debt except the mortgage

- Invest in tax-advantaged accounts

- Invest in real estate

Please drop a comment below, we’d love to hear your thoughts!

Related content: How We Save 56% of Our Income [Family of 3]

Related content: How We Budget Our $100K Income As A Family of Three

Disclaimer:

We hope the information in this article provides valuable insights to every reader but we, the Biesingers, are not financial advisors. When making your personal finance decisions, research multiple sources and/or receive advice from a licensed professional. As always, we wish you the best in your pursuit of financial independence!